CAGR: How to Calculate CAGR on Your Own

Understanding the compound annual Growth Rate (CAGR) is vital for all investors aiming to expand their portfolios in the Indian financial market. CAGR provides a realistic estimate of an investment’s annual gains, helping investors compare and track the performances of different investment options over the same time.

CAGR, a widely used financial metric, measures the mean annual growth rate of an investment over a predetermined period, provided the investment has been compounded over that time. CAGR reflects the annual return necessary for an investment to grow from its initial to its final value, assuming the profits are reinvested at the end of each year.

Let’s explore how to calculate CAGR on your own.

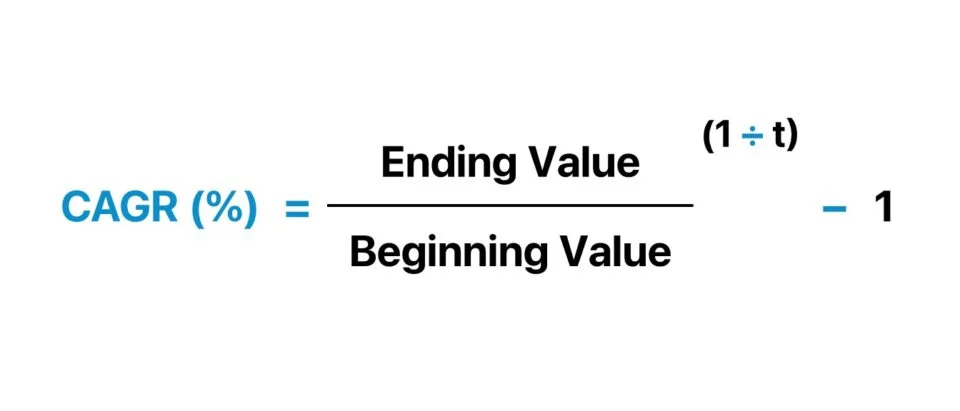

CAGR formula:

The formula for calculating CAGR is as follows:

CAGR = (Ending Value / Beginning Value)^(1/n) – 1

Where:

Ending Value = Value of the investment at the end of the period.

Beginning Value = Value of the investment at the start of the period.

n = Number of years.

For example, if an investor initiates with an investment of ₹1,00,000 and after five years it grows to ₹1,50,000. Using the above formula, the CAGR would be as follows:

CAGR = (₹1,50,000 / ₹1,00,000) ^ (1/5) – 1 = 8.44%

Thus, the investment’s Compound Annual Growth Rate (CAGR) over the five-year period is 8.44%.

Understanding CAGR helps investors draw a clear comparison between different investment avenues, as it offers a precise picture of an investment’s annual growth rate. Additionally, it also solves the issue created by Return on Investment (ROI) that could variate each year and does not provide a clear long term perspective.

Having said that, it is important for the investors to apply their discretion before finalizing an investment opportunity and understand that historical results are not always indicative of future performance.

The investor must gauge all the pros and cons of trading in the Indian financial market. The CAGR should not be the only deciding factor while making an investment decision. Other factors such as risk tolerance, investment horizon, and financial goals should also be taken into consideration.

Disclaimer: Trading and investing in markets carry high levels of risk. The above-mentioned calculation is meant for educative purposes only. Readers are advised to seek appropriate professional consultation before making any investment decisions.

See also: income tax slab for fy 2024 25

In summary, CAGR is a handy tool for estimating the growth of varied investments over time. It is simple to calculate on your own, making it a critical part of wise investment decision making, especially in an emerging and vibrant market like India.

Leave Your Comment